Quantitative Methods - Quantitative Methods Section 2

- Option : B

- Explanation : When a dice is rolled, since there are a finite number of outcomes, it is an example of a discrete probability distribution. The continuous uniform distribution is defined over a range from a lower limit ‘a’ to an upper limit ‘b’. A normal distribution is symmetrical and bell-shaped.

72. The notation "F (x) = P (X < x)" best describes which of the following?

- Option : A

- Explanation : The cumulative distribution function gives the probability that a random variable X is less than or equal to a particular value x, P (X < x). Probability function specifies probability that random variable takes on a specific value. Probability density function is used for continuous random variables.

- Option : B

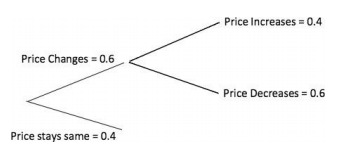

- Explanation : Consider the tree diagram below: The probability of a price decrease is equal to the probability of a price change times the probability of a decrease given a change = 0.6 * 0.6 = 0.36.

The probability of a price decrease is equal to the probability of a price change times the probability of a decrease given a change = 0.6 * 0.6 = 0.36.

The probability of a price decrease is equal to the probability of a price change times the probability of a decrease given a change = 0.6 * 0.6 = 0.36.

| Fund A | Fund B | ||

| Portfolio weights (%) | 45 | 55 | |

| Expected returns (%) | 23 | 13 | |

| Standard deviations (%) | 14 | 6 | |

| Correlation between the returns of Fund X and Fund Y | 0.7 | ||

The portfolio standard deviation of the returns is closest to:

- Option : B

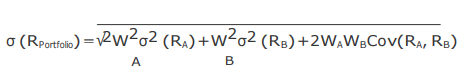

- Explanation : The portfolio standard deviation of the returns is calculated through

following formula:

And covariance is calculated through following formula:

Cov(RARB)=ρ (RARB) σ (RA)σ(RB)

First calculate the covariance, Cov= 0.7 ∗ .14 ∗ .06 = 0.00588, then

enter values in the formula 1 for calculating portfolio standard

deviation, you should get portfolio standard deviation = 8.90%.

And covariance is calculated through following formula:

Cov(RARB)=ρ (RARB) σ (RA)σ(RB)

First calculate the covariance, Cov= 0.7 ∗ .14 ∗ .06 = 0.00588, then

enter values in the formula 1 for calculating portfolio standard

deviation, you should get portfolio standard deviation = 8.90%.